mattstoller | Three weeks ago, the government passed a giant multi-trillion dollar

bailout. Supposedly, it was money for a host of stakeholders, including

hospitals, states, Wall Street banks, big business, the unemployed, and

small businesses. Today the Federal Reserve built on top of Congress’s

framework, announcing

yet another multi-trillion dollar set of facilities, on top of what it

already put out, to help cities, states, small businesses, main street

businesses, and so on and so forth.

So what has happened so far?

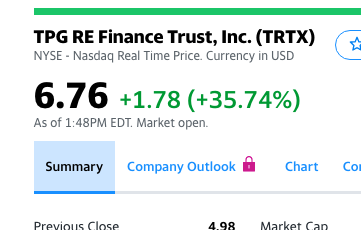

This is today’s change in stock price of a real estate venture run by

one of largest private equity funds in the world.

A

thirty five percent jump in a day is… a lot. The reason the stock

skyrocketed is because investors believe the new measures from the

Federal Reserve will bailout the debt of this private equity fund.

There’s a ‘monetary bazooka’ aimed at the economy. And yet there’s a

puzzle. If there’s money for the entire economy, why is that normal

people and small businesses can’t access unemployment insurance and

lending programs? To put it another way, why is the money meant for

everyone only showing up in the stock market?

The reason is

because money has to travel through institutions, and right now, the

institutions for the powerful function well, and those for the rest of

us are rickety and broken. So money gets to the rich first. Eventually,

some money will get to the rest of us, but in the interim period before

that money fully circulates, the wealthy can use their access to money

to buy up physical or financial assets.

An 18th century French

banker and philosopher named Richard Cantillon noticed an early version

of this phenomenon in a book he wrote called ‘An Essay on Economic Theory.’

His basic theory was that who benefits when the state prints a bunch of

money is based on the institutional setup of that state. In the 18th

century, this meant that the closer you were to the king and the

wealthy, the more you benefitted, and the further away you were, the

more you were harmed. Money, in other words, is not neutral. This

general observation, that money printing has distributional consequences

that operate through the price system, is known as the “Cantillon

Effect.”

0 comments:

Post a Comment