Thursday, January 14, 2016

poor canucks aboot to get the sharp short end of the stick...,

By

CNu

at

January 14, 2016

0

comments

![]()

Labels: Collapse Casualties , contraction , weather report

oil and u.s. share prices tumble, even yeezus have to slash prices...,

The S&P 500, which closed at 1,890 points, suffered its worst day since September and has fallen by 10% since its November peak taking it into “correction” territory, something that has not happened since August 2014.

The Dow Jones industrial average dropped by 364 points, or 2.2%, to 16,151, and the Nasdaq composite dropped 159 points, or 3.4%, to 4,526. This deepened the New York stock exchange’s already worst start to a year on record.

Wednesday’s stock market declines were triggered by new figures showing US gasoline stockpiles had increased to record high, which caused Brent crude prices to fall as low as $29.96, their lowest level since April 2004, before settling at $30.31, a 1.8% fall. The oil price has fallen by 73% since a peak of $115 reached in the summer of 2014.

Industry data showed that US gasoline inventories soared by 8.4m barrels and stocks of diesel and heating oil increased by more than 6m barrels – confirming the forecasts of many analysts that a huge oversupply of oil could keep prices low during most of 2016.

Analysts said that growing fears of a weakening outlook for the global economy, made worse by falling oil prices, was behind the steep falls. Some oil analysts this week predicted that the price could fall as low as $10.

In recent days several analysts have warned that the global economy could suffer a repeat of the 2008 crash if the knock-on effects of a contraction in Chinese output pushes down commodity prices further and sparks panic selling on stock and bond markets.

By

CNu

at

January 14, 2016

0

comments

![]()

Labels: Collapse Casualties , contraction , weather report

Friday, October 16, 2015

armor, ammunition, and drones easier to implement than jobs and education...,

It undercuts productivity, spending, and investment, stunting national growth. Itcontributes to inequality and spurs social tension. Joblessness and inactivity and the failure to tap into the economic aspirations and resources of young people carry an even higher price.As prospects dwindle, many face social exclusion, or see their emotional, mental, or physical health deteriorate....Young people account for roughly 40 percent of the world’s unemployed and are up to four times more likely to be unemployed than adults....When young people are not fully participating in the labor force or are NEETs, governments forgo tax revenue and incur the cost of social safety nets, unemployment benefits and insurances, and lost roductivity. Businesses risk losing a generation of consumers.Social costs are ever mounting as well. The Arab Spring and subsequent youth-led uprisings in many countries, along with the rise of economic insurgency and youth extremism,demand that we explore the links between economic participation, inequality, and community security, crime, and national fragility through a lens focused on youth. What we see is a generation in economic crisis.Over the next decade, a billion more young people will enter the job market—and only 40 percent are expected to be able to enter jobs that currently exist. The global economy will need to create 600 million jobs over the next 10 years: that’s 5 million jobs each month simply to keep employment rates constant.

By

CNu

at

October 16, 2015

0

comments

![]()

Labels: Collapse Casualties , contraction , musical chairs , WW-III

Thursday, October 01, 2015

chiraq 311 callers will get used to new delhi english with a hindi accent...,

By

CNu

at

October 01, 2015

0

comments

![]()

Labels: contraction , corporatism , professional and managerial frauds

Friday, September 25, 2015

kansas city becomes 6th regional fed survey flashing red

|

| regional Fed survey collapse goes on... Dallas, Richmond, New York, Philly, Chicago, and now Kansas City... |

By

CNu

at

September 25, 2015

0

comments

![]()

Labels: contraction , quorum sensing? , weather report

Friday, August 07, 2015

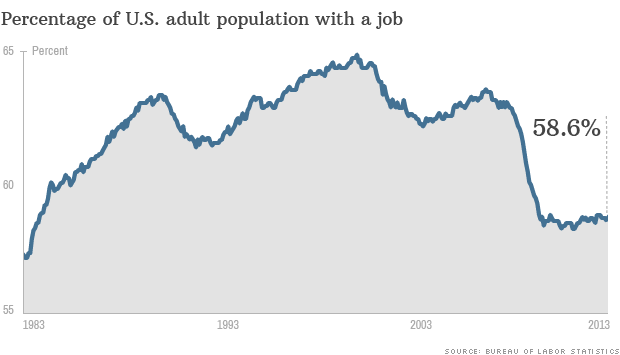

jobs lost in the u.s. since 2007

By

CNu

at

August 07, 2015

0

comments

![]()

Labels: Collapse Casualties , contraction , musical chairs

roughly 60% of the civilian work force is fully employed and 40% are marginally employed or unemployed

By

CNu

at

August 07, 2015

0

comments

![]()

Labels: Collapse Casualties , contraction , The Hardline , truth

Tuesday, June 30, 2015

no sex and status-seeking at the root of ______________?

By

CNu

at

June 30, 2015

0

comments

![]()

Labels: Collapse Casualties , contraction , doesn't end well

Monday, June 29, 2015

bad sex and ego at the root of austerity?

By

CNu

at

June 29, 2015

0

comments

![]()

Labels: austerity , contraction , reality casualties , What Now?

Saturday, June 27, 2015

what electricity consumption tells us about the state of the u.s. economy...,

- An increase in efficiency means that the same output can be obtained with less inputs. Therefore, a small-ish reduction in electricity consumption versus a prior period may not necessarily be indicative of a sluggish economy over that time. And we know that this efficiency has been on the rise in recent years (just look at the power rating of your new appliances).

- Likewise, a warmer winter versus the prior year may also cause a drop in electricity consumption, simply due to home heaters not being used as hard, not necessarily because the economy is doing badly.

By

CNu

at

June 27, 2015

17

comments

![]()

Labels: contraction , Hanson's Peak Capitalism , industrial ecosystems

Thursday, May 14, 2015

Saturday, May 09, 2015

26 waiters and bartenders for every manufacturing job added...,

By

CNu

at

May 09, 2015

0

comments

![]()

Labels: Collapse Casualties , contraction , musical chairs

Saturday, March 21, 2015

read this and reflect on our own political situation...,

By

CNu

at

March 21, 2015

12

comments

![]()

Labels: Collapse Crime , contraction , neofeudalism , What IT DO Shawty...

Thursday, February 26, 2015

Technological progress in a market economy is therefore self-terminating, and ends in collapse

By

Dale Asberry

at

February 26, 2015

6

comments

![]()

Labels: agenda , consumerism , contraction , corporatism , de-evolution , ecosystems , externalities , industrial ecosystems , institutional deconstruction , Irreplaceable Natural Material Resources , Peak Capitalism

Tuesday, February 10, 2015

a new theory of energy and the economy

By

CNu

at

February 10, 2015

19

comments

![]()

Labels: contraction , Hanson's Peak Capitalism , What Now?

baltic dry index at its lowest level ever...,

By

CNu

at

February 10, 2015

0

comments

![]()

Labels: contraction , Hanson's Peak Capitalism

Wednesday, February 04, 2015

2015 already looking to be an exciting year

By

Dale Asberry

at

February 04, 2015

0

comments

![]()

Labels: Collapse Casualties , contraction , doesn't end well , not a good look , peak employment , What Now? , you used to be the man

Tuesday, October 28, 2014

does couch potato 2.0 see these interwebs as "zillion channel" teevee?

By

CNu

at

October 28, 2014

0

comments

![]()

Labels: cognitive infiltration , consumerism , contraction , corporatism , de-evolution , Living Memory

Thursday, September 25, 2014

clubs, commons, or just no banksters? privatized indiana toll road going bankrupt due to contraction?

By

CNu

at

September 25, 2014

0

comments

![]()

Labels: Collapse Casualties , contraction , corporatism , What Now?

Tuesday, July 01, 2014

unemployment problem is bigger than nyc and la combined...,

By

CNu

at

July 01, 2014

1 comments

![]()

Labels: Collapse Casualties , contraction , What IT DO Shawty...

The Weaponization Of Safety As A Way To Criminalize Students

Slate | What do you mean by the “weaponization of safety”? The language is about wanting to make Jewish students feel saf...

-

theatlantic | The Ku Klux Klan, Ronald Reagan, and, for most of its history, the NRA all worked to control guns. The Founding Fathers...

-

Video - John Marco Allegro in an interview with Van Kooten & De Bie. TSMATC | Describing the growth of the mushroom ( boletos), P...

-

Farmer Scrub | We've just completed one full year of weighing and recording everything we harvest from the yard. I've uploaded a s...