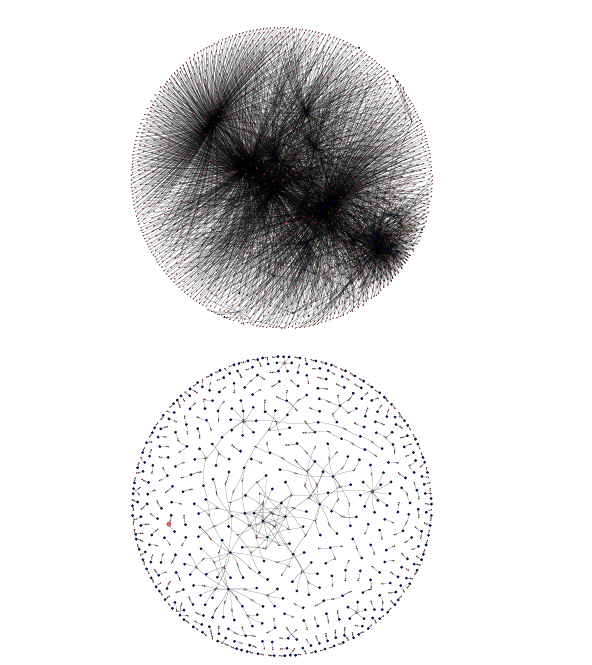

arvixblog | The study of complex networks has given us some remarkable insights into the nature of systems as diverse as forest fires, the internet and earthquakes. This kind of work is even beginning to give econophysicists a glimmer of much-needed insight in the nature of our economy. In a major study, econophysicists have today identified the most powerful companies in the world based on their ability to control stock markets around the globe. it makes uncomfortable reading.When it comes to complex networks, economics has always been poorly understood. That’s at least partly to do with the complexity of the networks n question. It is relatively straightforward to draw up a set of nodes representing the shareholders of major companies and draw in the links between them. This kind of analysis has shown that the control of stock markets is distributed between many nodes.

arvixblog | The study of complex networks has given us some remarkable insights into the nature of systems as diverse as forest fires, the internet and earthquakes. This kind of work is even beginning to give econophysicists a glimmer of much-needed insight in the nature of our economy. In a major study, econophysicists have today identified the most powerful companies in the world based on their ability to control stock markets around the globe. it makes uncomfortable reading.When it comes to complex networks, economics has always been poorly understood. That’s at least partly to do with the complexity of the networks n question. It is relatively straightforward to draw up a set of nodes representing the shareholders of major companies and draw in the links between them. This kind of analysis has shown that the control of stock markets is distributed between many nodes.This kind of basic graphing tells you nothing about the way ownership changes as shares are bought and sold. Another important variable is the market capitalization of the companies–their size–which has an important effect on the dynamics. In theory, including these factors can give you a much greater insight not only into the ownership of these companies, but also into their control.

Now James Glattfelder and Stefano Battiston at the Swiss Federal Institute of Technology in Zurich have included these factors in a study of the control and ownership of stockmarkets in 48 countries around the world. Their results are startling.

It turns out that the insight gained from a simple network analysis –that ownership and control is distributed over large numbers of people–is entirely misleading. When other factors are included, such as the way ownership changes as shares are bought and sold, it turns out that stock markets are controlled by a very small number of companies.

Glattfelder and Battiston have even identified the companies with the greatest power in each of the stockmarkets they study. They have even created a list of global powerbrokers, the companies that are influential in the most stock markets around the world. Here is the top 10:

1. The Capital Group Companies

2. Fidelity Management & Research

3. Barclays PLC

4. Franklin Resources

5. AXA

6. JPMorgan Chase & Cp

7. Dimensional Fund Advisors

8. Merrill Lynch & Co

9. Wellington Management Company

10. UBS

These are the companies that control the global stockmarket. That’s a frightening though. What it suggests is that the stability of the complex networks that make up our economy is hugely dependent on the ongoing survival of just a handful of companies.

We’re entitled to ask whether they’re up to the job. Recent experience suggests not.

The Backbone of Complex Networks of Corporations: Who is Controlling Whom?

0 comments:

Post a Comment