Tuesday, April 12, 2011

Monday, April 11, 2011

backbone of complex networks of corporations: The flow of control

arvix | We present a methodology to extract the backbone of complex networks based on the weight and direction of links, as well as on nontopological properties of nodes. We show how the methodology can be applied in general to networks in which mass or energy is flowing along the links. In particular, the procedure enables us to address important questions in economics, namely, how control and wealth are structured and concentrated across national markets. We report on the first cross-country investigation of ownership networks, focusing on the stock markets of 48 countries around the world. On the one hand, our analysis confirms results expected on the basis of the literature on corporate control, namely, that in Anglo-Saxon countries control tends to be dispersed among numerous shareholders. On the other hand, it also reveals that in the same countries, control is found to be highly concentrated at the global level, namely, lying in the hands of very few important shareholders. Interestingly, the exact opposite is observed for European countries. These results have previously not been reported as they are not observable without the kind of network analysis developed here.

arvix | We present a methodology to extract the backbone of complex networks based on the weight and direction of links, as well as on nontopological properties of nodes. We show how the methodology can be applied in general to networks in which mass or energy is flowing along the links. In particular, the procedure enables us to address important questions in economics, namely, how control and wealth are structured and concentrated across national markets. We report on the first cross-country investigation of ownership networks, focusing on the stock markets of 48 countries around the world. On the one hand, our analysis confirms results expected on the basis of the literature on corporate control, namely, that in Anglo-Saxon countries control tends to be dispersed among numerous shareholders. On the other hand, it also reveals that in the same countries, control is found to be highly concentrated at the global level, namely, lying in the hands of very few important shareholders. Interestingly, the exact opposite is observed for European countries. These results have previously not been reported as they are not observable without the kind of network analysis developed here.

By

CNu

at

April 11, 2011

1 comments

![]()

Labels: cognitive infiltration , Deep State

econophysicists identify world’s top 10 most powerful companies

arvixblog | The study of complex networks has given us some remarkable insights into the nature of systems as diverse as forest fires, the internet and earthquakes. This kind of work is even beginning to give econophysicists a glimmer of much-needed insight in the nature of our economy. In a major study, econophysicists have today identified the most powerful companies in the world based on their ability to control stock markets around the globe. it makes uncomfortable reading.When it comes to complex networks, economics has always been poorly understood. That’s at least partly to do with the complexity of the networks n question. It is relatively straightforward to draw up a set of nodes representing the shareholders of major companies and draw in the links between them. This kind of analysis has shown that the control of stock markets is distributed between many nodes.

arvixblog | The study of complex networks has given us some remarkable insights into the nature of systems as diverse as forest fires, the internet and earthquakes. This kind of work is even beginning to give econophysicists a glimmer of much-needed insight in the nature of our economy. In a major study, econophysicists have today identified the most powerful companies in the world based on their ability to control stock markets around the globe. it makes uncomfortable reading.When it comes to complex networks, economics has always been poorly understood. That’s at least partly to do with the complexity of the networks n question. It is relatively straightforward to draw up a set of nodes representing the shareholders of major companies and draw in the links between them. This kind of analysis has shown that the control of stock markets is distributed between many nodes.This kind of basic graphing tells you nothing about the way ownership changes as shares are bought and sold. Another important variable is the market capitalization of the companies–their size–which has an important effect on the dynamics. In theory, including these factors can give you a much greater insight not only into the ownership of these companies, but also into their control.

Now James Glattfelder and Stefano Battiston at the Swiss Federal Institute of Technology in Zurich have included these factors in a study of the control and ownership of stockmarkets in 48 countries around the world. Their results are startling.

It turns out that the insight gained from a simple network analysis –that ownership and control is distributed over large numbers of people–is entirely misleading. When other factors are included, such as the way ownership changes as shares are bought and sold, it turns out that stock markets are controlled by a very small number of companies.

Glattfelder and Battiston have even identified the companies with the greatest power in each of the stockmarkets they study. They have even created a list of global powerbrokers, the companies that are influential in the most stock markets around the world. Here is the top 10:

1. The Capital Group Companies

2. Fidelity Management & Research

3. Barclays PLC

4. Franklin Resources

5. AXA

6. JPMorgan Chase & Cp

7. Dimensional Fund Advisors

8. Merrill Lynch & Co

9. Wellington Management Company

10. UBS

These are the companies that control the global stockmarket. That’s a frightening though. What it suggests is that the stability of the complex networks that make up our economy is hugely dependent on the ongoing survival of just a handful of companies.

We’re entitled to ask whether they’re up to the job. Recent experience suggests not.

The Backbone of Complex Networks of Corporations: Who is Controlling Whom?

By

CNu

at

April 11, 2011

0

comments

![]()

Labels: Deep State

Sunday, April 10, 2011

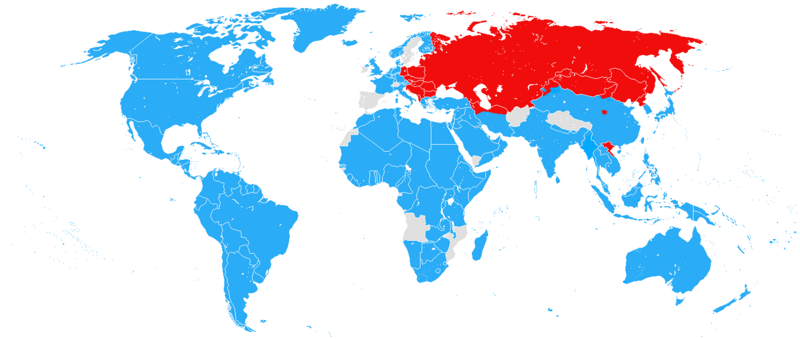

controlling africa and ejecting russia and china from the mediterranean

LewRockwell | In the 1930s the US, Great Britain, and the Netherlands set a course for World War II in the Pacific by conspiring against Japan. The three governments seized Japan’s bank accounts in their countries that Japan used to pay for imports and cut Japan off from oil, rubber, tin, iron and other vital materials. Was Pearl Harbor, Japan’s response?

LewRockwell | In the 1930s the US, Great Britain, and the Netherlands set a course for World War II in the Pacific by conspiring against Japan. The three governments seized Japan’s bank accounts in their countries that Japan used to pay for imports and cut Japan off from oil, rubber, tin, iron and other vital materials. Was Pearl Harbor, Japan’s response?Now Washington and its NATO puppets are employing the same strategy against China.

Protests in Tunisia, Egypt, Bahrain, and Yemen arose from the people protesting against Washington’s tyrannical puppet governments. However, the protests against Gaddafi, who is not a Western puppet, appear to have been organized by the CIA in the eastern part of Libya where the oil is and where China has substantial energy investments.

Eighty percent of Libya’s oil reserves are believed to be in the Sirte Basin in eastern Libya now controlled by rebels supported by Washington. As seventy percent of Libya’s GDP is produced by oil, a successful partitioning of Libya would leave Gaddafi’s Tripoli-based regime impoverished.

The People’s Daily Online (March 23) reported that China has 50 large-scale projects in Libya. The outbreak of hostilities has halted these projects and resulted in 30,000 Chinese workers being evacuated from Libya. Chinese companies report that they expect to lose hundreds of millions of yuan.

China is relying on Africa, principally Libya, Angola, and Nigeria, for future energy needs. In response to China’s economic engagement with Africa, Washington is engaging the continent militarily with the US African Command (AFRICOM) created by President George W. Bush in 2007. Forty-nine African countries agreed to participate with Washington in AFRICOM, but Gaddafi refused, thus creating a second reason for Washington to target Libya for takeover.

A third reason for targeting Libya is that Libya and Syria are the only two countries with Mediterranean sea coasts that are not under the control or influence of Washington. Suggestively, protests also have broken out in Syria. Whatever Syrians might think of their government, after watching Iraq’s fate and now Libya’s it is unlikely that Syrians would set themselves up for US military intervention. Both the CIA and Mossad are known to use social networking sites to foment protests and to spread disinformation. These intelligence services are the likely conspirators that the Syrian and Libyan governments blame for the protests.

Caught off guard by protests in Tunisia and Egypt, Washington realized that protests could be used to remove Gaddafi and Assad. The humanitarian excuse for intervening in Libya is not credible considering Washington’s go-ahead to the Saudi military to crush the protests in Bahrain, the home base for the US Fifth Fleet.

If Washington succeeds in overthrowing the Assad government in Syria, Russia would lose its Mediterranean naval base at the Syrian port of Tartus. Thus, Washington has much to gain if it can use the cloak of popular rebellion to eject both China and Russia from the Mediterranean. Rome’s mare nostrum (“our sea”) would become Washington’s mare nostrum.

“Gaddafi must go,” declared Obama. How long before we also hear, “Assad must go?”

The American captive press is at work demonizing both Gaddafi and Assad, an eye doctor who returned to Syria from London to head the government after his father’s death.

The hypocrisy passes unremarked when Obama calls Gaddafi and Assad dictators. Since the beginning of the 21st century, the American president has been a Caesar. Based on nothing more than a Justice Department memo, George W. Bush was declared to be above US statutory law, international law, and the power of Congress as long as he was acting in his role as commander-in-chief in the “war on terror.”

By

CNu

at

April 10, 2011

4

comments

![]()

Labels: Obamamandian Imperative , The Great Game

islamic banking and finance...,

Executive | Middle Eastern banks at center of sharia-compliant finance

Executive | Middle Eastern banks at center of sharia-compliant finance

Islamic banking and finance has clearly found its home in the Gulf. The region leads the industry by housing two thirds of global assets, worth roughly $350 billion. Also, the world’s leading Islamic financial institutions are all headquartered in the Gulf states and they routinely export their business model to Asia, Europe and Africa. Ninety percent of incremental retail-banking production in Saudi Arabia is Islamic, but Bahrain acts as the regional hub for Islamic finance. This is largely because the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) is based in Manama.

However, despite Bahrain’s role as a hub for Islamic finance, with 28 Islamic banks based in the island state, the market share for Islamic banks in the country is only 7%, according to a recent report by Moody’s. The other surprise in the study is that Oman is a Gulf state with no Islamic banks.

A closer examination of the regional sharia-compliant scene reveals that the largest Islamic commercial bank by total assets is Saudi Arabia’s Al Rajhi Bank, with more than $28 billion in assets. Second in line comes the historic Kuwait Finance House at $21.8 billion, followed by Dubai Islamic bank with $17.5 million.

Future Trends

It will be important to watch Noor Islamic Bank, based in Dubai. Started as a project of Sheikh Mohammed bin Rashid al Maktoum, Noor’s ultimate goal is to become the largest Islamic bank in the world. It only recently launched with ten branches in the UAE and intends to follow an Emirates Airlines model in order to solidify the market base, including a significant focus on customer service and innovative products.

When asked when Noor will break into the regional banking scene, a senior official at the bank remarked that this is confidential, but added: “I can say that whenever we are feeling very strong in the UAE, then we will look to the outside.” Considering who is backing the project, this will probably not take very long and one can expect an aggressive, regional Noor very soon.

Another bank to watch is the Abu Dhabi Islamic Bank, the second largest Islamic bank in the Emirates. ADIB recently entered the Egyptian market with the purchase of a 51% stake in Egypt’s National Bank for Development for $28 million. This was a bold move considering the poor reception Islamic banking is receiving in Egypt at the moment. Five years ago, a ruling by Mohammed al-Tantawi, one of Egypt’s highest-ranking Islamic scholars, essentially permitted earning a fixed amount of capital on an invested principle, largely seen as allowing interest. The move has been a large contributor to the crippled pace of development of Islamic finance in the country.

However, despite the current poor climate, the potential for Islamic banking in Egypt is huge, and one should expect more moves from Abu Dhabi Islamic Bank into Egypt, possibly in the form of a buyout.

A recent Middle East Business Intelligence report said it best, when it opined, “If Abu Dhabi Islamic Bank can make a success of offering Islamic products, the whole market will open up. We have already seen some of the local banks start to advertise their Islamic products in view of the competition for customers they see about to begin.”

Clearly Islamic banks in the Gulf are already anticipating the day when their home markets are saturated. And it appears that Egypt will be on the next front-line in the development of regional Islamic banking and finance.

By

CNu

at

April 10, 2011

10

comments

![]()

Labels: Deep State

why glenn beck's ghetto pass was revoked...,

By

CNu

at

April 10, 2011

6

comments

![]()

Labels: high strangeness , History's Mysteries

what history looks like in mexico

Narconews | Yesterday, multitudes took to the streets in more than 40 Mexican cities - and in protests by Mexicans and their friends at consulates and embassies in Europe, North America and South America - to demand an end to the violence wrought by the US-imposed "war on drugs."

Narconews | Yesterday, multitudes took to the streets in more than 40 Mexican cities - and in protests by Mexicans and their friends at consulates and embassies in Europe, North America and South America - to demand an end to the violence wrought by the US-imposed "war on drugs."What? You haven't heard about this? Or if you have heard something about it, did you know that it is the biggest news story in the Mexican media, on the front page of virtually every daily newspaper in the country?

A sea change has occurred in Mexican public opinion. The people have turned definitively against the use of the Mexican Army to combat against drug traffickers. The cry from every city square yesterday was for the Army to return to its barracks and go back to doing the job it was formed to do; protect Mexico from foreign invasion and provide human aid relief in case of natural disasters such as earthquakes and hurricanes. Since President Felipe Calderón unleashed the Armed Forces, four years ago, to combat drug trafficking organizations, the violence between it and the competing narco organizations has led to a daily body count, widespread human rights abuses against civilians, and more than 40,000 deaths, so many of them of innocent civilians caught in the crossfire and used by all sides in the armed conflict that still has no winners, that never will have any winner.

A fast moving series of events that began on March 28 have converged to usher Mexico into its very own "Arab spring." And it began just outside "the City of Eternal Spring," Cuernavaca, in the state of Morelos, about an hour south of Mexico City. Narco News has been covering these events for the past week (sadly, we are so far the only English-language media to do so at each step of the story, even as it has huge consequences for United States drug policy not only in Mexico but throughout the world and at home). On that date, in the town of Temixco, seven young men were assassinated. These were kids with jobs, who went to school, model kids, not criminals. And one of those kids, Juan Francisco Silvia, was the son of a nationally respected journalist and poet, Javier Sicilia, of Cuernavaca.

In a week, the soft spoken, increasingly beloved, intellectual has become the national vessel through which millions of voices now demand: End the war on drugs.

We translated Javier's Open Letter to Mexico's Politicians and Criminals this week, and penned what is our third editorial in eleven years to provide you with context and background to understand the magnitude of what he has unearthed. Yesterday we translated his statements calling for the legalization of drugs to restore peace and dignity to Mexico, and then we headed out to report the marches that this increasingly and deservedly beloved man called for to happen only days ago. We had reporters with Sicilia in his city of Cuernavaca, in Mexico City, and correspondents in numerous other Mexican and international locations, and over the course of the day I will be adding photos and more information about what happened to this page as updates.

Truth is that so much has happened in a day that processing it all tends to overwhelm. Last night, returning from the marches, ten reporters, photographers and video makers (all students or professors at the School of Authentic Journalism) met to compare notes. Everyone was so shaken - I mean that in the best possible way - by what we had seen and heard, and wanted to talk about it, to understand what exactly is happening here on the other side of the US border.

By

CNu

at

April 10, 2011

0

comments

![]()

Labels: Deep State

before things got chaotic in tunisia.....,

Telegraph | Islamic investment bank Gulf Finance House (GFH) and the Tunisian government have created the first offshore finance centre in North Africa. The centre will be part of Tunis Financial Harbour, a $3 billion (£2 billion) waterfront development in Raoued North, Tunis which is expected to create around 16,000 jobs for the Tunisian economy.

Telegraph | Islamic investment bank Gulf Finance House (GFH) and the Tunisian government have created the first offshore finance centre in North Africa. The centre will be part of Tunis Financial Harbour, a $3 billion (£2 billion) waterfront development in Raoued North, Tunis which is expected to create around 16,000 jobs for the Tunisian economy.GFH, which is based in Bahrain, hopes that the centre will allow Tunisia to take advantage of its strategic position on the Mediterranean sea, and operate as a bridge between the EU and the rapidly growing economies of North Africa.

Esam Janahi, executive chairman of GFH said: “Tunis Financial Harbour will be North Africa’s first offshore financial services centre. Tunisia’s strategic location means that it is the natural base for a financial services hub to cater for the growing demand for financial products and services created by the growth of not only the Tunisian economy but also African economies and international investment flows into the country.”

Taoufik Baccar, governor of the Central Bank of Tunisia, added that the country has “a clear strategy of establishing Tunis as a leading regional financial services centre.”

Tunisia has undergone increasing economic liberalization over the last decade, after a long perod of strict state control. In the 2010-2011 World Economic Forum Global Competitiveness Report, it was ranked as the most competitive country in Africa, as well as the 32nd most economically competitive country globally.

By

CNu

at

April 10, 2011

64

comments

![]()

Labels: Deep State

state owned central bank of china

Wikipedia | The People's Bank of China (PBC or PBOC) is the central bank of the People's Republic of China with the power to control monetary policy and regulate financial institutions in mainland China. The People’s Bank of China has more financial assets than any other single public finance institution in world history.

Wikipedia | The People's Bank of China (PBC or PBOC) is the central bank of the People's Republic of China with the power to control monetary policy and regulate financial institutions in mainland China. The People’s Bank of China has more financial assets than any other single public finance institution in world history.The bank was established on December 1, 1948 based on the consolidation of the Huabei Bank, the Beihai Bank and the Xibei Farmer Bank. The headquarters was first located in Shijiazhuang, Hebei, and then moved to Beijing in 1949. Between 1949 and 1978 the PBC was the only bank in the People's Republic of China and was responsible for both central banking and commercial banking operations.

In the 1980s, as part of economic reform, the commercial banking functions of the PBC were split off into four independent but state-owned banks and in 1983, the State Council promulgated that the PBC would function as the central bank of China. Mr. Chen Yuan was instrumental in modernizing the bank in the early 1990's. Its central bank status was legally confirmed on March 18, 1995 by the 3rd Plenum of the 8th National People's Congress. In 1998, the PBC underwent a major restructuring. All provincial and local branches were abolished, and the PBC opened nine regional branches, whose boundaries did not correspond to local administrative boundaries. In 2003, the Standing Committee of the Tenth National People's Congress approved an amendment law for strengthening the role of PBC in the making and implementation of monetary policy for safeguarding the overall financial stability and provision of financial services.

By

CNu

at

April 10, 2011

0

comments

![]()

Labels: Deep State

state owned central bank of libya

Wikipedia | The Central Bank of Libya (CBL) is 100% state owned and represents the monetary authority in The Great Socialist People’s Libyan Arab Jamahiriya and enjoys the status of autonomous corporate body. The law establishing the CBL stipulates that the objectives of the central bank shall be to maintain monetary stability in Libya , and to promote the sustained growth of the economy in accordance with the general economic policy of the state.

Wikipedia | The Central Bank of Libya (CBL) is 100% state owned and represents the monetary authority in The Great Socialist People’s Libyan Arab Jamahiriya and enjoys the status of autonomous corporate body. The law establishing the CBL stipulates that the objectives of the central bank shall be to maintain monetary stability in Libya , and to promote the sustained growth of the economy in accordance with the general economic policy of the state.The headquarter of the Central Bank is in Tripoli. However, to make the CBL services more accessible to commercial banks branches and public departments located far from the headquarter, the CBL has three branches located in Benghazi , Sebha and Sirte.

The CBL started its operations on April 1, 1956 to replace the Libyan Currency committee which was established by the UN and other supervising countries in 1951 to ensure the well being of the Weak and poor Libyan economy. The primary aims of the Libyan Currency committee were to assist Libya in creating a unified currency in all four provinces.

By

CNu

at

April 10, 2011

24

comments

![]()

Labels: Deep State

Saturday, April 09, 2011

dreams reveal our body's cares

ChinaDaily | A pioneering traditional Chinese medicine doctor suggests that dreams can be early warning signs of physical problems. Ye Jun delves deeper.

ChinaDaily | A pioneering traditional Chinese medicine doctor suggests that dreams can be early warning signs of physical problems. Ye Jun delves deeper.For 10 years, retiree Li Rong had a recurrent nightmare, in which she fell into a countryside squat toilet and was unable to get out. "It certainly wasn't a dream of blooming flowers or a flowing stream and it didn't feel good," says the 49-year-old former laborer from Beijing.

Determined to find the reason behind this disturbing nightmare, she consulted with traditional Chinese medicine (TCM) Dr Liu Jie, at the Yu Yuan Tang Clinic in Beijing.

Liu's explanation was nothing like the traditional interpretation of dreams offered by psychoanalysts such as Sigmund Freud and Carl Jung, whose explanations were usually rooted in the subconscious.

"The toilet hole in her dream refers to the colon," Liu says. "The fact she couldn't move in the hole corresponds to the dachangshu, an acupuncture point in the back, or the second lumbar, which is close to the colon."

Liu checked Li's back to confirm his suspicion and found the third lumbar of the vertebra was out of alignment. After he corrected it, Li's nightmare was over.

The 43-year-old Liu is licensed to prescribe herbal medicine, but his specialty is structural adjustment of the body. Over the past two years, he has discovered a fascinating link between his patients' dreams and structural problems related to his patients' bodies. He is now able to use dream analysis to help with diagnosis and treatment.

"The simplest link between dreams and the body is a similarity in shape," Liu says. "For example, if you dream of an overpass, it could correspond to the colon because they have a similar structure."

Dreams reveal our body's cares

Likewise, dreaming of a ditch may refer to the ureter; while a pond or small lake indicates the bladder. Dreaming of the sky or clouds could refer to the lungs (air); while mountain climbing could suggest a problem with the back. If there are stairs on the mountain it is more likely to indicate a spinal dysfunction.

Liu's first dream interpretation was in January 2009. Roy Chen, a 37-year-old who works for an educational NGO helping orphans in Guangzhou, told the doctor about his dream when he was having acupuncture treatment.

Chen dreamed he was sitting in an empty subway carriage, when he discovered two lost bags on the ground, one of them red. He opened one of the bags and saw an ID card bearing his name.

Liu's interpretation suggested the subway carriage related to Chen's intestines, as they both move around in an empty space. He said the big bag referred to the stomach while the small bag was the spleen. Because the bigger bag was red, Liu reasoned there could be excessive heat in Chen's stomach.

After confirming this by taking Chen's pulse, Liu prescribed medicines to dispel the excessive heat and the acne on Chen's chin disappeared.

Liu then started recording his patients' dreams and currently has a record of more than 80, with interpretations, which he has uploaded on to his blog.

"Dreams are generally defined as conscious or unconscious brainwave activity," Liu says. "As a TCM doctor, I see some dreams as a reflection of the movement of qi, or energy, in the body, on the conscious level.

"The body has a self-checking and self-correcting system that works all the time. During the day people are too occupied to notice. But in the evening these energy changes in the body can manifest themselves as dreams."

By

CNu

at

April 09, 2011

2

comments

![]()

Labels: as above-so below

the body of myth

GoogleBook | The thesis of this book is that the "body of myth" is the physical body as perceived by yogis during yogic trance (samadhi). Proprioception (the "white noise" of the senses idling in the absence of external sensory input) on various anatomical regions, including the senses themselves or other bodily regions, gave rise to an esoteric body of description of interior states experienced during samadhi. These descriptions constitute the stuff of mythology. Thus, the Greek assault upon the very door of Troy represents proprioception on the skull's fissure located at the position of the third eye, the assault being the yogi's breath internally stimulating the fissure during pranayama. The work is interesting, extremely well-grounded in its familiarity with Greek mythology and Patanjali yoga, and is exemplary in its lived scholarship. Like Mircea Eliade, the author is no mere book-bound "scholar" but lives and breathes in these topics. Examples abound--but that is part of the problem. First, although all the myths discussed are capitalized (e.g., the ASSAULT ON TROY), there is nowhere a glossary summarizing these tales for the mythologically challenged. Second, like Darwin, the author argues geologically, adducing scores of examples, layer piled upon layer, that not so much convince as cause conformity from sheer pressure and the weight of example. The thesis would gain empirical support were it discovered that the ancient Greeks were familiar with yogic practices. But nothing like that is known (and is certainly unlikely prior to Alexander's 4th c. BCE Indian campaign). And the Eleusian Mysteries--the major Greek esoteric tradition--remain just that, mysteries. True, it is difficult to prove *any* thesis in *any* literary criticism, because ancient texts do not fully speak to the praxis (which was trasmitted experientially) and because texts, like the gods, are multivalent. Still, an interesting read....

By

CNu

at

April 09, 2011

0

comments

![]()

Labels: as above-so below

Friday, April 08, 2011

the japanese economy is in very dire straits

EconomicCollapse | Now that nearly a month has gone by since the horrific tsunami in Japan on March 11th, it is starting to become clear just how much economic damage has been done. The truth is that the Japanese economy is in much bigger trouble than most people think. This is almost certainly going to be the most expensive disaster in Japanese history. The tsunami that struck Japan on March 11th swept up to 6 miles inland, destroying virtually everything in the way. Thousands upon thousands of Japanese were killed and entire cities were wiped off the map. Yes, Japan is a resilient nation, but exactly how does a nation that is already drowning in debt replace dozens of cities and towns that are suddenly gone? The truth is that thousands of square miles have been more completely destroyed than if they had been bombed by a foreign military force. The loss of homes, cars, businesses and personal wealth is almost unimaginable. It is going to take many years to rebuild the roads, bridges, rail systems, ports, power lines and water systems that were lost. Nobody is quite sure when the rolling blackouts are going to end, and nobody is quite sure when all of the damaged manufacturing facilities are going to be fully brought back online.

EconomicCollapse | Now that nearly a month has gone by since the horrific tsunami in Japan on March 11th, it is starting to become clear just how much economic damage has been done. The truth is that the Japanese economy is in much bigger trouble than most people think. This is almost certainly going to be the most expensive disaster in Japanese history. The tsunami that struck Japan on March 11th swept up to 6 miles inland, destroying virtually everything in the way. Thousands upon thousands of Japanese were killed and entire cities were wiped off the map. Yes, Japan is a resilient nation, but exactly how does a nation that is already drowning in debt replace dozens of cities and towns that are suddenly gone? The truth is that thousands of square miles have been more completely destroyed than if they had been bombed by a foreign military force. The loss of homes, cars, businesses and personal wealth is almost unimaginable. It is going to take many years to rebuild the roads, bridges, rail systems, ports, power lines and water systems that were lost. Nobody is quite sure when the rolling blackouts are going to end, and nobody is quite sure when all of the damaged manufacturing facilities are going to be fully brought back online.The truth is that this is a complete and total economic disaster.

The Japanese economy is not going to be the same for many years to come. In fact, many are now warning that this could be one of the triggers that could lead to another major global financial crisis.

One of the big fears is that Japan will need to sell off a large amount of U.S. Treasuries to fund the rebuilding of that nation.

If that were to happen, it could result in a "liquidity crisis" similar to what we saw in 2008. Already the rest of the world is really starting to lose confidence in the U.S. dollar and in U.S. Treasuries, and if Japan starts massively dumping U.S. government debt things could get out of control fairly quickly.

In any event, it is undeniable that the Japanese economy has been absolutely devastated by this crisis. In fact, when you combine the tsunami and the nuclear crisis, this could be the biggest economic disaster that any major industrial power has faced since World War 2.

So will the crisis in Japan push the rest of the globe into another major recession?

By

CNu

at

April 08, 2011

5

comments

![]()

Labels: Collapse Casualties , What Now?

Thursday, April 07, 2011

japan's peak oil dry run

OurWorld | Each Monday for the next few weeks, in light of the recent triple disaster, our new Transition Japan series will consider the challenges faced by Japan in dealing with climate change, peak oil, food security and biodiversity loss. In today’s first installment, Brendan Barrett takes a look at how Japan’s post-tsunami response might help us to respond to peak oil.

OurWorld | Each Monday for the next few weeks, in light of the recent triple disaster, our new Transition Japan series will consider the challenges faced by Japan in dealing with climate change, peak oil, food security and biodiversity loss. In today’s first installment, Brendan Barrett takes a look at how Japan’s post-tsunami response might help us to respond to peak oil.For large parts of eastern Japan that were not directly hit by the tsunami on 11 March 2011, including the nation’s capital, the current state of affairs feels very much like a dry-run for peak oil. This is not to belittle the tragic loss of life and the dire situation facing many survivors left without homes and livelihoods. Rather, the aim here is to reflect upon the post-disaster events and compare them with those normally associated with the worst-case scenarios for peak oil.

The earthquake and tsunami affected six of the 28 oil refineries in Japan and immediately petrol rationing was introduced with a maximum of 20 litres per car (in some instances as low as 5 litres). On 14 March, the government allowed the oil industry to release 3 days’ worth of oil from stockpiles and on 22 March an additional 22 days’ worth of oil was released.

The Tokyo Electric Power Company (TEPCO), which serves a population of 44.5 million, lost one quarter of its supply capacity as a result of the quake, through the closedown of its two Fukushima nuclear power plants (Dai-ichi and Dai-ni), as well as eight fossil fuel based thermal power stations. Subsequently, from 14 March 2011 onwards, TEPCO was forced to implement a series of scheduled outages across the Kanto region (the prefectures of Gunma, Tochigi, Ibaraki, Saitama, Tokyo, Chiba, and Kanagawa).

While the thermal power stations may restart operations soon, the overall shortfall will become even more difficult to manage over the summer period when air conditioning is utilized. The reality is that these power cuts could continue for years, especially since the one of the two Fukushima nuclear plants has effectively become a pile of radioactive scrap.

Related to this, when the Tokyo Metropolitican Government began to announce levels of radioactive contamination of drinking water above permissible levels, this was immediately followed by the rapid sell-out of bottled water, even after the levels dropped again. When bottled water is on sale in local convenience stores after some restocking took place, each customer is only allowed to purchase one 2 litre bottle.

Immediately after the quake, supermarkets outside the disaster area in Tokyo and other major cities began to sell out of foodstuffs, including various instant meals. The electrical appliance stores sold out of batteries, flashlights and portable radios.

As we all know, the twin natural and human tragedies are having impacts beyond the Tohoku region where Fukushima lies, and the Greater Tokyo area. It has been difficult for Japan’s notoriously efficient industries to maintain production, given that they rely on just-in-time systems and which have supply plants (for needed parts) that are located in the zone impacted by these combined disasters. One example is in car production, where major firms have had to suspend work at their factories when key parts are no longer available from the affected region. The fragility of this system of industrial production is glaringly obvious and it is something that peak oil commentators have warned of multiple times.

These food and bottled water shortages, power cuts, fuel-rationing and breakdowns in just-in-time manufacturing have been anticipated by those who take peak oil seriously. It is almost as if eastern Japan is experiencing a peak oil rehearsal, although other regions of Japan are virtually unaffected. If proponents of peak oil are correct, then the rest of the world may experience something similar within the next 5 to 10 years, and hence it is important that we learn valuable lessons from Japan’s response to the current circumstances.

By

CNu

at

April 07, 2011

3

comments

![]()

what we can learn from japan about sustainability

Cassandralegacy | what I would like to do today is to discuss what we can learn from Japan in terms of sustainability.

So, let me start with something about the history of Japan. You surely know of the early "Heian" or "Imperial" period that started long ago; it was the "classical" period of Japanese history. Then, the Heian age gave way to a period of civil wars; the sengoku jidai, the period of the Samurai. Many movies have shown it as a romantic age, but I am sure the people who lived in it didn't find it very romantic; it was a period of continuous wars and it must have been very hard for everyone. Anyway, that historical phase was over when Tokugawa Ieyasu emerged as the winner of the struggle and he became the shogun, the ruler of all Japan. That was around the year 1600 and it started the "Edo" period which was much quieter. The Edo period lasted until Commodore Perry arrived with his "black ships" in mid 19th century and that started the modern period.

Now, the two centuries and a half of the Edo Period are very interesting in terms of sustainability. It was not just a period of peace; it was also a period of stable economy and of stable population. Actually, that is not completely true, population increasing during the first part of the Edo period, but when it arrived to about 30 million, it stayed nearly constant for almost two centuries. I don't know of another society in history that managed such a period of stability. It was an example of what we call today "steady state" economy.

The reason why most societies can't manage to reach a steady state is because it is very easy to overexploit the environment. It is not something that has to do just with fossil fuels. It is typical of agricultural societies, too. Cut too many trees and the fertile soil will be washed away by rain. And then, without fertile soil to cultivate, people starve. The result is collapse - a common feature of most civilizations of the past. Jared Diamond wrote about that in a book of a few years ago; titled, indeed "Collapse".

Now, there is an interesting point that Diamond makes about islands. On islands, he says, people have limited resources - much more limited than on continents - and their options are limited. When you run out of resources, say, of fertile soil, you can't migrate and you can't attack your neighbors to get resources from them. So, you can only adapt or die. Diamond cites several cases of small islands in the Pacific Ocean where adaptation was very difficult and the results have been dramatic, such as in the case of Easter Island. In some really small islands, adaptation was so difficult that the human population simply disappeared. Everybody died and that was it.

And that brings us to the case of Japan; an island, of course, although a big one. But some of the problems with resources must have been the same as in all islands. Japan doesn't have much in terms of natural resources. A lot of rain; mostly, but little else and rain can do a lot of damage if forests are not managed well. And, of course, space is limited in Japan and that means that there is a limit to population; at least as long as they have to rely only on local resources. So, I think that at some point in history the Japanese had reached the limit of what they could do with the space they had. Of course, it took time; the cycle was much longer than for a small island such as Easter Island. But it may well be the civil wars were a consequence of the Japanese society having reached a limit. When there is not enough for everyone, people tend to fight but that, of course, is not the way to manage scant resources. So, at some point the Japanese had to stop fighting, they had to adapt or die - and they adapted to the resources they had. That was the start of the Edo period.

In order to attain steady state, the Japanese had to manage well their resources and avoid wasting them. One thing they did was to get rid of the armies of the warring period. War is just too expensive for a steady state society. Then, they made big effort to maintain and increase their forests. You can read something on this point in Diamond's book. Coal from Kyushu may have helped a little in saving trees, but coal alone would not have been enough - it was the management of forests that did the trick. Forests were managed to the level of single trees by the government; a remarkable feat. Finally, the Japanese managed to control population. That was possibly the hardest part in an age when there were no contraceptives. From what I read, I understand that the poor had to use mainly infanticide and that must have been very hard for the Japanese, as it would be for us today. But the consequences of letting population grow unchecked would have been terrible; so they had to.

We tend to see a steady state economy as something very similar to our society, only a bit quieter. But Edo Japan was very different. Surely it was not paradise on earth. It was a highly regulated and hierarchical society where it would have been hard to find - perhaps even to imagine - such things as "democracy" or "human rights". Nevertheless, the Edo period was a remarkable achievement; a highly refined and cultured society. A society of craftsmen, poets, artists and philosophers. It created some of the artistic treasures we still admire today; from the katana sword to Basho's poetry.

So, the Japanese succeeded in creating a a highly refined society that managed to exist in a steady state for more than two centuries. I think there is no comparable case in history. Why did Japan succeed where many other societies in history had failed? Well, I think that being an island was a major advantage. It shielded (mostly) Japan from the ambitions of their neighbors and also from the temptation that the Japanese might have had to invade their neighbors. And if you are not so terribly afraid of being invaded (and you have no intention of invading anyone) then you have no reason to have a big army and so no reason to increase population. You can concentrate on sustainability and on managing what you have. Then, of course, when Commodore Perry and his black ships arrived Japan was not an island any more; in the sense that it was not any longer isolated from the rest of the world. So growth restarted. But, as long as Japan remained isolated, the economy remained in steady state and, as I said, it was a remarkable achievement.

But I don't think that the fact of being an island explains everything about the Edo period. I think, that it would not have been possible without a certain degree of wisdom. Or, perhaps, a more correct term in this case is "sapience."

By

CNu

at

April 07, 2011

1 comments

![]()

Labels: History's Mysteries , The Straight and Narrow

Chipocalypse Now - I Love The Smell Of Deportations In The Morning

sky | Donald Trump has signalled his intention to send troops to Chicago to ramp up the deportation of illegal immigrants - by posting a...

-

theatlantic | The Ku Klux Klan, Ronald Reagan, and, for most of its history, the NRA all worked to control guns. The Founding Fathers...

-

NYTimes | The United States attorney in Manhattan is merging the two units in his office that prosecute terrorism and international narcot...

-

Wired Magazine sez - Biologists on the Verge of Creating New Form of Life ; What most researchers agree on is that the very first functionin...