Video - CP&L CEO answers kwestins...,

Sunday, November 06, 2011

in six days: connecticut community resiliency failing on an epic scale...,

By

CNu

at

November 06, 2011

8

comments

![]()

Labels: Collapse Casualties , FAIL

stand up chicago shows how it's done!!!

Video - Wisconsin Koch Bros sockpuppet Scott Walker gets MIC checked in Chicago.

By

CNu

at

November 06, 2011

8

comments

![]()

Labels: micro-insurgencies , People Centric Leadership

how much of the global economy is useless friction?

By

CNu

at

November 06, 2011

1 comments

![]()

Labels: common sense , truth

Saturday, November 05, 2011

roman catholic church's pedophile investigator jailed for possessing thousands of child porn images

By

CNu

at

November 05, 2011

1 comments

![]()

Labels: psychopathocracy

that cop in oakland who injured scott olson was trying to kill somebody...,

By

CNu

at

November 05, 2011

6

comments

![]()

Labels: psychopathocracy

speaking of debt collection and debt collectors...,

By

CNu

at

November 05, 2011

0

comments

![]()

Labels: Livestock Management , psychopathocracy

twits tweeting telling on themselves...,

By

CNu

at

November 05, 2011

1 comments

![]()

Labels: facebook IS evil

Friday, November 04, 2011

democracy incompatible with debt collection

By

CNu

at

November 04, 2011

7

comments

![]()

Labels: Peak Capitalism , The Hardline

the corzine wall st. ag holder vampire squid gangster bankster backstory

By

CNu

at

November 04, 2011

6

comments

![]()

Labels: Obamamandian Imperative

greek governance exceedingly fluid about now...,

Video - Greek military and police had joined riots earlier this summer.

* General Ioannis Giagkos, chief of the Greek National Defence General Staff, to be replaced by Lieutenant General Michalis Kostarakos

* Lieutenant General Fragkos Fragkoulis, chief of the Greek Army General Staff, to be replaced by lieutenant general Konstantinos Zazias

* Lieutenant General Vasilios Klokozas, chief of the Greek Air Force, to be replaced by air marshal Antonis Tsantirakis

* Vice-Admiral Dimitrios Elefsiniotis, chief of the Greek Navy General Staff, to be replaced by Rear-Admiral Kosmas Christidis

By

CNu

at

November 04, 2011

0

comments

![]()

Labels: complications , governance

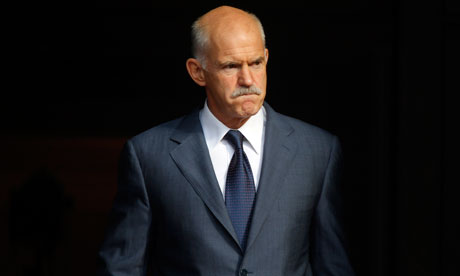

dayyum..., papandreou picked up the soap

By

CNu

at

November 04, 2011

0

comments

![]()

Labels: clampdown , Deep State , FAIL

Thursday, November 03, 2011

levels of symbiotic cooperation previously unknown...,

By

CNu

at

November 03, 2011

1 comments

![]()

Labels: symbiosis , What IT DO Shawty...

an educated mind depends on a properly trained behind...,

Video - A word about corporal punishment

By

CNu

at

November 03, 2011

11

comments

![]()

Labels: killer-ape , What IT DO Shawty...

the return to feudalism

By

CNu

at

November 03, 2011

5

comments

![]()

Labels: de-evolution , reality casualties

Wednesday, November 02, 2011

consent needed for debt repayments

By

CNu

at

November 02, 2011

2

comments

![]()

Labels: debt slavery , states rights

the achilles heel of the eurozone

By

CNu

at

November 02, 2011

1 comments

![]()

Labels: quorum sensing? , What Now?

Greece’s bailout referendum gambit: grave error or glimpse of greatness?

By

CNu

at

November 02, 2011

1 comments

![]()

Labels: elite , establishment , narrative

greek prime minister wins backing for referendum

The referendum will be a clear mandate and a clear message in and outside Greece on our European course and participation in the euro.

No one will be able to doubt Greece's course within the euro.

We will not implement any program by force, but only with the consent of the Greek people.

This is our democratic tradition and we demand that it is also respected abroad.

By

CNu

at

November 02, 2011

0

comments

![]()

Labels: People Centric Leadership

Global Economy Threatened As World Oil Production Stalls For Seventh Year

By

CNu

at

November 02, 2011

0

comments

![]()

Labels: Hanson's Peak Capitalism

Tuesday, November 01, 2011

the 99% have lost out beyond occupy wall street's wildest imagining..,

Video - an exploration of the inordinate power that corporations exercise in our democracy.

By

CNu

at

November 01, 2011

0

comments

![]()

a simple three item agenda...,

By

CNu

at

November 01, 2011

2

comments

![]()

Labels: accountability , agenda

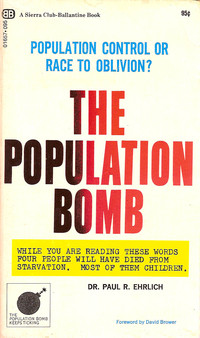

is the environmental crisis caused by the 7 billion or the 1%?

By

CNu

at

November 01, 2011

0

comments

![]()

Labels: Livestock Management , Peak Capitalism

we really need a widespread, bottom-up social movement

By

CNu

at

November 01, 2011

17

comments

![]()

Labels: Livestock Management , The Straight and Narrow

Chipocalypse Now - I Love The Smell Of Deportations In The Morning

sky | Donald Trump has signalled his intention to send troops to Chicago to ramp up the deportation of illegal immigrants - by posting a...

-

theatlantic | The Ku Klux Klan, Ronald Reagan, and, for most of its history, the NRA all worked to control guns. The Founding Fathers...

-

NYTimes | The United States attorney in Manhattan is merging the two units in his office that prosecute terrorism and international narcot...

-

Wired Magazine sez - Biologists on the Verge of Creating New Form of Life ; What most researchers agree on is that the very first functionin...