Global Research | The Democratic Republic of the Congo contains more than half the world’s cobalt. It holds one-third of its diamonds, and, extremely significantly, fully three-quarters of the world resources of columbite-tantalite or "coltan" -- a primary component of computer microchips and printed circuit boards, essential for mobile telephones, laptops and other modern electronic devices.

Global Research | The Democratic Republic of the Congo contains more than half the world’s cobalt. It holds one-third of its diamonds, and, extremely significantly, fully three-quarters of the world resources of columbite-tantalite or "coltan" -- a primary component of computer microchips and printed circuit boards, essential for mobile telephones, laptops and other modern electronic devices.America Minerals Fields, Inc., a company heavily involved in promoting the 1996 accession to power of Laurent Kabila, was, at the time of its involvement in the Congo’s civil war, headquartered in Hope, Arkansas. Major stockholders included long-time associates of former President Clinton going back to his days as Governor of Arkansas. Several months before the downfall of Zaire’s French-backed dictator, Mobutu, Laurent Desire Kabila based in Goma, Eastern Zaire had renegotiated the mining contracts with several US and British mining companies including American Mineral Fields. Mobutu’s corrupt rule was brought to a bloody end with the help of the US-directed International Monetary Fund.

Just weeks after President George W. Bush signed the Order creating a new US military command dedicated to Africa, AFRICOM, events on the mineral-rich continent have erupted which suggest a major agenda of the incoming Obama Presidency will be for the son of a black Kenyan to focus US resources, military and other, on dealing with the Republic of Congo, the oil-rich Gulf of Guinea, the oil-rich Darfur region of southern Sudan and increasingly the Somali ‘pirate threat’ to sea lanes in the Red Sea and Indian Ocean. The legitimate question is whether it is mere coincidence that Africa appears just at this time to become a new geopolitical ‘hot spot’ or whether it has a direct link to the formal creation of AFRICOM.

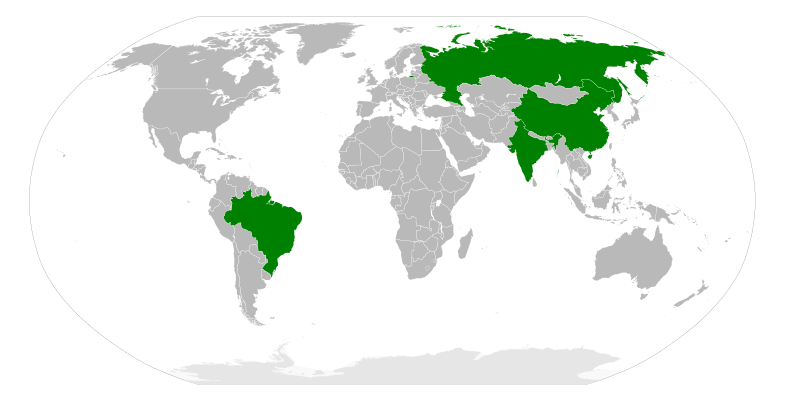

What is striking is the timing. No sooner had AFRICOM become operational than major new crises broke out in both the Indian Ocean-Gulf of Aden regarding spectacular incidents of alleged Somali piracy, as well as eruption of bloody new wars in Kivu Province in the Republic of Congo. The common thread connecting both is their importance, as with Darfur in southern Sudan, for China’s future strategic raw materials flow.